HOPE: SME RECOVERY Final Report

Thank you to everyone who supported SME Recovery campaign this year. We have completed the final report and there is no doubt that we had a big impact and have helped save a lot of small business by building an extraordinary alliance of representative bodies and local leaders.

Download Final ReportNational Recovery Plan and Budget 2021

As the Government works to finalise and publish its National Economic Recovery Plan and Budget 2021, the approach adopted must be based on the need to reboot the entire SME sector and not merely a smaller sub section of it. Pan-sectoral measures for the SME sector are equally as important as targeted sector-specific measures. Financial resilience in the SME sector can only be built with the right blend of policies to create financially strong and sustainable businesses.

Download Budget SubmissionOur Principal Objectives

Sustaining the Recovery

Building SME Resilience

Context & Coordination

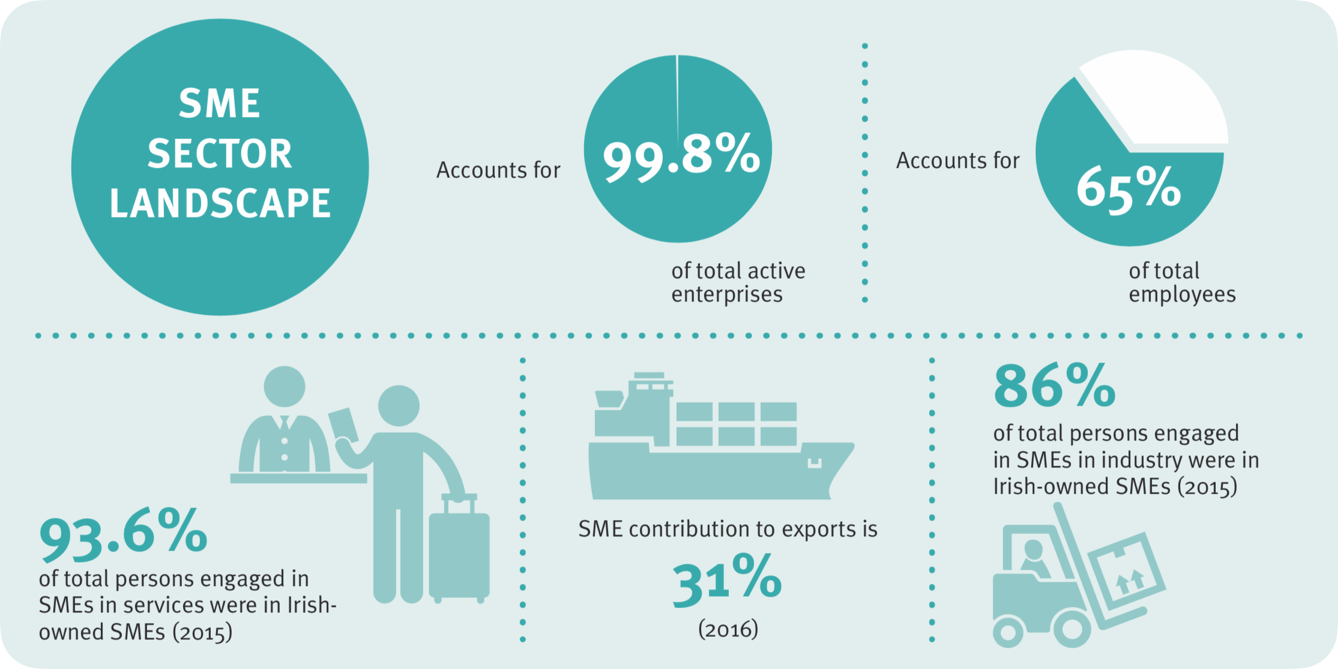

SOURCE: Seanad Public Consultation on Small and Medium Sized Businesses Report 2019

Sustaining the Recovery

As we navigate our way through and out of the Covid-19 pandemic as a society, the recovery for small businesses from the economic shock must be sustained. This can be achieved through provision of the following by Government:

- Easier to access loans and equity.

- An extension of the Credit Guarantee Scheme to December 2021 and within this a 100% guarantee on loans up to €50,000.

- A phased withdrawal of the Employee Wage Subsidy scheme from April to December 2021.

- A waiver of interest rates on warehoused VAT / PAYE liabilities.

- A fast-track of Examinership ‘Lite’ for implementation January 1st, 2021.

- The streamlining of Employment and Investment Incentive Scheme approvals with the Revenue commissioners.

- A waiving of Capital Gains Tax on equity investments into small businesses with €10m or less in revenue.

- An increase in the scale of and cash-back from the Start up Refunds for Entrepreneurs (SURE) scheme.

- Incentivisation of Directors loans into small businesses.

- Introduction of SME decarbonisation grants.

Building SME Resilience

A financially strong and resilient SME sector will benefit our economy and our communities throughout our country, particularly in rural communities. If our SME’s are more resilient, they are more sustainable, able to withstand shocks and have a stable base to grow and support the communities they operate within. Resilience can be achieved through the establishment of a:

- SME Rainy Day-Fund: Incentivise small businesses to set-aside 1% of their revenue on an annual basis as a rainy-day fund. This would be matched/part matched by Government. Segregated from the business operating account, each SME’s rainy-day fund would be managed by a 3rd party and called upon when needed.

- National SME Resilience Fund: To be accessed by viable SME’s who have fallen victim to a force majeure, to be administered by the NTMA.

- National Training Fund: An allocation to Local Enterprise Offices to complete a basic Business Owner Financial Literacy campaign.

- SME State Agency: The establishment of a State agency with specific responsibility for the SME sector.

Add your support to the SME Recovery Ireland!

Sign the Petition

Engage your local politician

Spread the word

We are no longer accepting submissions to the site.

We will not send you any emails or share your email with any other 3rd party.